Shell Chemical Appalachia LLC, a Shell subsidiary located in Houston, Texas (Dun & Bradstreet, n.d.), decided in 2016 after a long planning period to invest in building and operating an ethane cracker to support polyethylene resin manufacturing in southwestern Pennsylvania (“Shell Takes Final Investment Decision to Build a New Petrochemicals Complex in Pennsylvania, US,” n.d.a). The 386-acre Pennsylvania Petrochemicals Complex (Figure 1) is adjacent to the Ohio River in Potter and Center townships near the borough of Monaca in Beaver County, Pennsylvania (“Pennsylvania Petrochemicals Complex,” n.d.a, “Project development”). Polyethylene is a feedstock for manufacturing plastic products, especially packaging and auto components. Polyethylene is produced from ethylene created from steam processing of ethane, a natural gas liquid found in some gas streams in the Marcellus and Utica shale formations.

Figure 1: Pennsylvania Petrochemicals Complex Under

Construction.

(Photo Taken in March 2022 by David Passmore.)

Shell has confirmed that the Pennsylvania Petrochemicals Complex will commence operations in 2022 (Shrum 2022a). In December 2021, a Shell Chemical Appalachia executive said that “Much of the work is done….Now we are tying the various larger structures together” (Suttles 2020). One estimate places the cost of the Complex at $10 billion (Schneider 2019).

Why Pennsylvania? And, why Beaver County? “The basic answer is very simple,” said Ate Visser at a 2016 industry conference in Pittsburgh. At the time, Visser was an executive with Shell Chemical Appalachia. Visser said, “You’re sitting here on a world-class resource base at the doorstep of your customer (Cocklin 2016a).” Leaders of oil and gas industry associations in Ohio, Pennsylvania, and West Virginia noted that “Our three states produce roughly one-third of America’s natural gas, making Appalachia the third largest gas producer in the world – behind only the U.S. itself and Russia” (Callahan, Brundrett, and Burd 2022). More than 70% of the North American polyethylene market exists within a 700-mile radius of the Complex (“Pennsylvania Petrochemicals Complex,” n.d.b, “Project development”).

Gist (2016) wrote that “The Shell cracker represents one of the biggest-ever industrial investments in the tristate region (Pennsylvania, Ohio, and West Virginia), whose industrial sector suffered a series of set-backs through the second half of the 20th century (para. 4).” Whitfield and Rajeevee (2018) described a study [“Report and Plans Released for Enhancing Petrochemicals, Plastics Manufacturing in Pennsylvania” (2017)]1 for the Team Pennsylvania Foundation (“Team PA Foundation,” n.d.) that predicted “significant new investments in energy infrastructure such as gas gathering lines, pipelines, storage facilities, and fractionation plants (para. 3).

Shell stuck with its decision to invest in the Complex, even though many Shell projects worldwide were delayed, resized, or canceled altogether due to a downturn in worldwide oil and gas markets as the Complex project commenced (Davis 2016).

In This Blog Posting….

In the remainder of this posting I review risk, uncertainty, and gaps in information that could influence the perceptions of the economic impact of the Pennsylvania Petrochemicals Complex. The flow of this blog posting follows three threads:2

- First, I delineate some questions about the markets affecting the

Complex, the worthiness of public expenditures on the Complex, and the

regional economic effects that the public expects from the operation. I

highlight the importance of evidence about the expected economic impact

to promote public acceptance of the Complex and to stimulate the need

for public expenditures to support the Complex.

- Next, I outline my simple understanding of the steps in operating

the Pennsylvania Petrochemicals Complex. Understanding the nature and

structure of inputs, processes, and outputs of the Complex shapes

expectations for the regional economic impact of the Complex.

- And, last, I critically examine a report by professors associated with Robert Morris University that was supported by Shell Chemical Appalachia LLC. This report, Updated Economic Impact Analysis: Petrochemical Facility in Beaver County, Pennsylvania (Clinton, Minutolo, and O’Roark 2021a), was produced before the Complex will open for business. Many readers of the Robert Morris report might view information presented as persuasive evidence about the potential positive impact of the Complex on the regional economy.3

Questions

Remain About the

Viability of the Complex

Can Product and Resource Markets Sustain the Complex?

Risk, uncertainty, and volatility plague markets for fossil fuels and products derived from these fuels. In September 2020, Moody’s (2020) raised questions about the creditworthiness of new fossil fuel projects. Markets, regulations, and environmental concerns affecting the quality of human life are influencing the viability of the business proposition for added fossil fuel capacity.

According to a biting 2020 opinion offered by Sanzillo and Hipple (2020c), the Pennsylvania Petrochemical Complex faces prospects of low product prices, price and supply volatility in ethane feedstock markets, risk of oversupply of polyethylene resins that the Complex will manufacture, stiff competition from other producers, competition from the supply of recycled plastics materials, and the influence of possible low general economic growth (Figure 2 is a plot of recent natural gas price volatility). Concluded by the Institute was that the Complex “will open to market conditions that are more challenging than when the project was planned. The [C]omplex is likely to be less profitable than expected and face an extended period of financial distress (Sanzillo and Hipple (2020c), p.1; see, also, Bruggers (2020) and Place (2022)).”

Figure 2: Volatility of Natural Gas Prices, 2018-2021.

(Plot from Disavino (2021).)

Tax Expenditures by Pennsylvania Citizens Are Large…But Prudent?

The Commonwealth of Pennsylvania allocated funds to support the preparation of the site for the Complex in Monaca. In addition, the Commonwealth offered tax and financial incentives to site the Complex in Pennsylvania. However, using the term “incentives” makes the Commonwealth’s decision sound distant from its financial accounting. Make no mistake, though. These incentives plainly are tax expenditures, defined in an accounting sense by the U.S. Treasury (“Tax Expenditures,” n.d.; see, also, Hellerstein and Coenen 1966, 793) as

revenue losses attributable to provisions of Federal tax laws which allow a special exclusion, exemption, or deduction from gross income or which provide a special credit, a preferential rate of tax, or a deferral of tax liability. These exceptions are often viewed as alternatives to other policy instruments, such as spending or regulatory programs. (para. 1)

As a consequence of excluding taxes and offering tax credits for the Pennsylvania Petrochemicals Complex, citizens of the Commonwealth forego the opportunity to collect general fund revenue. Also, revenue reduction from these expenditures and credits could require the Commonwealth to raise taxes to remain revenue-neutral (Sammartino and Toder 2020, 4). In 2019, Stacker, a news organization, calculated that the tax breaks allocated to the Pennsylvania Petrochemicals Complex ranked 13th in dollar value out of 50 national projects receiving corporate subsidies from governments over 20 years (Crisafulli, n.d.).

If projects were judged on costs alone, few investments would occur. Instead, citizens must weigh the costs of public investment in this private venture against the benefits to the regional economy that could accrue from the operation of the Complex. As I will assert in more detail in this blog posting, I do not believe that these benefits have been demonstrated well before the Complex will open.

Expenditures for Site Preparation

Funds from Act 2 of 1995 (“Land Recycling and Environmental Remediation Standards Act (Act of May. 19, 1995,p.l. 4, No. 2 Cl. 27) - LAND,” n.d.) – which supports remediation of tracts of land that were developed for industrial purposes, polluted and then abandoned (aka “brownfields”) – funded a portion of the costs of preparation of the site, which was the location of a former zinc smelter. Remediation involved covering the site with clean fill, installing a synthetic cap over previous disposal areas on the property, and collecting and treating potentially contaminated storm water before discharge (“Shell Petrochemical Complex,” n.d.a). Ate Visser, speaking for Shell at a 2016 industry conference in Pittsburgh, said that construction of the Complex would have been impossible without Act 2 funds (Cocklin 2016b, para. 7).

Commonwealth expenditures did not alone fund site preparation. Shell incurred significant expenses. For example, Shell committed $80 million on top of Act 2 funds to clean up environmental contamination at the site and prepare the land for construction of the Complex (Cocklin 2016b, para. 6). A PennDOT spokesman said Shell paid for a $60 million project to alter a Commonwealth roadway, Pennsylvania Route 18, and make other road fixes at the site (Bumsted 2016). Also, Shell paid nearly $70 million to move Center Township’s water intake site and build Township a new water treatment plant. The water intake was located where Shell built docking facilities for equipment delivery during the Complex’s construction phase (Cocklin 2016c, para. 4).

Tax Expenditures Offered as Incentives to Site in Pennsylvania

The Commonwealth of Pennsylvania used tax expenditures as incentives for siting petrochemical plants such as the Complex in Pennsylvania:

- Act 16 in 2012 (“Keystone Opportunity Zone, Keystone

Opportunity Expansion Zone, and Keystone Opportunity Improvement Zone

Act – Omnibus Amendments (Act of Feb. 14, 2012, p. L. 183, No.

16),” n.d.) makes petrochemical manufacturers like

Shell exempt from all corporate net income taxes and property taxes for

15 years after first occupying the Beaver County site, as long as it

invests at least one billion dollars (not necessarily in Pennsylvania)

and creates at least 400 new permanent full-time jobs. Shell said it

would deploy 600 jobs to operate the Complex (“Pennsylvania Petrochemicals Complex,”

n.d.a, “Environment and society”).

- Act 85 in 2012 (“Tax Reform Code of 1971 – Omnibus Amendments (Act of Jul. 2, 2012, p. L. 751, No. 85),” n.d., “Article XVII-G”) gives Shell a tax credit of 5 cents for every gallon of ethane it buys to manufacture ethylene, provided that 2,500 full-time equivalent jobs are created during construction of the Complex (≅6,000 were, according to Shell (“Shell Starts Main Construction on Pennsylvania Petrochemicals Complex in USA,” n.d.)). Shell will pay no taxes as stipulated in Act 16, but Shell can benefit by selling unused credits as tax equity for other purchasing firms to reduce their own tax liability.

Figure 3: Pennsylvania Act 16 and Act 85.

(Images

captured from www.legis.state.pa.us website

and edited by David

Passmore)

Thomas Corbett, Pennsylvania Governor at the time, initially sought an annual $66 million tax credit for 25 years, a total of $1.65 billion. Suppose the Complex sustains between 400 to 600 jobs annually for 25 years, a rough, undiscounted calculation4 indicates a cost per job, a recognized economic development metric (Sahota (n.d.) and UK Homes & Communities Agency (2015)),5 over the 25-year period between $2.75 million and $13 million, which equals $165,000 to $112,000 per job per year. A dollar figure capping expenditures was not placed in the final draft of the legislation, meaning that the credits are unlimited and flexible (Bumsted 2012). Shell’s Visser said, “I can tell you, with hand to my heart, that without these incentives, we would not have made this investment decision (Cocklin 2016d, para. 6).” Governor Corbett, who steered these expenditures through legislation, said, “When you’re looking at the investment you have to look at what it would have cost us had we done nothing, had we let these businesses go” (Detrow 2012c).

Are Tax Expenditures Effective as Incentives?

The extant research literature examining the relationship between offering tax incentives and consequent economic growth is complex, varied, and inconclusive (Buss 2001a, 94–100). In particular, evidence is weak that firm-specific tax incentives increase broader economic growth at the state and local levels (Slattery and Zidar 2020). T. J. Bartik (2020) reported that so-called “place-based” policies cost around $60 billion annually (in 2019 dollars) and that the typical state and local incentive offer, as a percent of the value-added of the business receiving an incentive, tripled in size in the 30 years preceding 2019.

The body of research is thin about the economic growth that resulted from using state and local expenditures of tax revenue to subsidize private firms. State governments prefer not to conduct rigorous evaluations of the costs and benefits of tax expenditures used to incent site location (Buss 2001b). An open question is whether Shell might have decided to relocate to the West Virginia, Ohio, and Pennsylvania region, if not Beaver County, even without incentives, especially if the region offers unique and desirable business opportunities. According to T. Bartik (2018), in 9 out 10 cases firms receive a tax incentive for a location decision that they would have made, even if no incentive had been provided (p. 40 and note 60 on p. 127). Also, an important consideration is whether a location of the Complex in Ohio or West Virginia, rather than Pennsylvania, would have been less beneficial for Pennsylvania residents. As far as I know, the Commonwealth has not embarked on an assessment of the effectiveness of Act 16 and Act 85 expenditures on economic growth in the Commonwealth. The net public benefit of tax expenditures made on the Pennsylvania Petrochemicals Complex remains to be demonstrated.

Food and Water Watch (2020) cataloged the long history of failed tax incentives in Pennsylvania, including luring Volkswagen to Westmoreland County and the European shipbuilder Kvaerner to the Philadelphia shipyard, enticing the Vanguard Group to keep its corporate offices from moving out of state, and offering state and city grants for a Comcast building in Philadelphia (p. 4). Even so, Pennsylvania Governor Corbett enthusiastically compared his announcement of the tax expenditure deal with the petrochemical industry to “what it must have been like when the first steel mill was built in Pittsburgh, starting an industry that had never been here before” (Murphy 2016). “I think it’s important not only for the young generation but generations yet to be born,” Corbett said. “It’s going to establish an industry here in western Pennsylvania that I think has the potential to grow to considerable size.”

What Are Stakeholders’ Perspectives of the Complex?

Shell’s Stake, Different Than the Public’s

The Pennsylvania Petrochemicals Complex sums to a massive long-term investment of money, time, effort, and planning by Shell. Shell undoubtedly foresees a financial return from investing in the Complex, even though the Complex will face the vagaries of resource and product markets and emerging regulation, as will any forward-looking decision in the energy sector. Shell makes decisions as a private enterprise with shared ownership among stockholders. As such, Shell properly must invoke the criterion of “what’s in it for us and, ultimately, our shareholders” in its decisions.

Deep inside the company’s spreadsheets, Shell must have weighed on a finely-tuned scale the current and future costs, risks, uncertainties, revenue, and profits in the balance of its worldwide business efforts to yield the momentous decision to move forward with the Complex. Proceeding to build and operate the Complex was a complex, bold, and courageous business decision made by one of the largest independent energy firms in the world. Much is at stake for Shell.

Shell’s success also could positively impact the regional economy in proportion that the inputs purchased for the Pennsylvania Petrochemical Complex originate in the region and its outputs are sold and used subsequently for manufacturing in the region. However, such an impact on the regional economy is incidental and not essential for Shell’s financial success with the Complex. Obtaining a return from the Commonwealth’s tax expenditures is essential for Pennsylvania citizens, though. The Commonwealth’s tax expenditures reduce Shell’s costs in exchange for a job, income. and wage tax possibilities derived in the short term by construction and in the long term by operation of the Complex.

The Public’s Interest, Different Than Shell’s

Through the Commonwealth’s expenditures of tax revenues, Pennsylvania citizens have become significant financial stakeholders in the Complex. Yet, measures of success expected from the Complex by Pennsylvania citizens are not the same as Shell’s. Citizens seek regional economic impact from their investments in the form of jobs and income for citizens and tax revenue for governments to fund public goods and services. Commonwealth and local tax collection from Shell were foregone by state legislation, however.

These expenditures of tax revenues for Shell and other energy companies came at the same time as reduced Pennsylvania spending for county-level public health programs and other public services and an across-the-board $1 billion cut in state spending (Detrow 2012d, para. 2). In addition, negotiations about these expenditures remained hidden from public view due to confidentiality agreements with Shell (Phillips 2012). Governor Thomas Corbett,

“Pushed back against the argument the tax break is a corporate giveaway, saying, ‘They think we’re giving money to them. No we’re not. What we’re saying is, you build it. You provide all these jobs for all these people. And we’ll take a little less money from you, so we have more money for us.’” (Detrow 2012a)

Any enterprise engaging in business transactions – even an enterprise so primitive as a child’s lemonade stand – generates an economic impact. So, there is no doubt that the Pennsylvania Petrochemicals Complex will have some impact on the regional economy. But, in what way? By how much? Will the benefits of regional economic impact cover the costs of expenditures of revenue collected from Pennsylvania citizens? Cui bono? Answers to these critical questions about the public benefits of the Complex would help justify expenditures on the Complex by Pennsylvania citizens.

Assertions

of Potential Regional Impact Were

Influential in Opinions About the

Complex

Without a doubt, several reports from the American Chemistry Council, a trade association,6 framed the potential benefits of the Pennsylvania Petrochemicals Complex for Pennsylvania citizens, their elected legislators, and public officials. In 2011, the Council reported (American Chemistry Council and Statistics 2011, 1) that a 25% increase in ethane supply on growth in the petrochemical sector would generate 17,000 new knowledge-intensive, high-paying jobs in the U.S. chemical industry and 395,000 additional jobs outside the chemical industry. Also concluded was that this investment would generate $4.4 billion more in federal, state, and local tax revenue annually ($43.9 billion over 10 years).

In 2012, the American Chemistry Council issued an addendum to their national report that focused on the economic impact of natural gas development in Pennsylvania. The Council asserted that an additional $4.8 billion in chemical industry activity would generate over 2,400 high-paying, desirable jobs in the Pennsylvania chemical industry (American Chemistry Council and Statistics 2012a, para. 4). In addition, new petrochemical production in Pennsylvania would stimulate purchases of raw materials, services, and other purchases throughout the supply chain, producing more than 8,200 indirect jobs and generating 7,000 payroll-induced jobs in the state. A one-time $3.2 billion investment in a Pennsylvania petrochemical complex would result in more than $900 million in spending inside the state of Pennsylvania (American Chemistry Council and Statistics 2012b, para. 6)

The Council also indicated that construction of a petrochemical facility, purchase of new equipment for the facility, and operation of the facility would result in federal and state tax revenues of $363 million and local tax revenues of $141 million (American Chemistry Council and Statistics 2012c, Table 3 and Table 4).

These reports were influential at the front edge of the advancing natural gas revolution, the “pivot of the world’s energy future” (Kolb 2014), in Pennsylvania and other states in the northeast United States. The Commonwealth of Pennsylvania did not produce its own independent study of the potential economic impact of ethane cracking and plastic resin production in Pennsylvania (S. Detrow 2012a) – nor did it finish a study that it started in time to affect legislation on tax expenditures (S. Detrow 2012b, para. 10). Pennsylvania Governor Thomas Corbett trusted the American Chemistry Council’s estimates of potential economic impact (Detrow 2012b).

The American Chemical Society’s reports about the potential economic impact of the Pennsylvania Petrochemicals Complex were the linchpins in the appeal that secured the allocation of tax expenditures through Act 16 and Act 85 to support the construction and operation of the Complex. However, questions remain about the validity of the American Chemical Society estimates of the potential economic impact of the Complex and, therefore, whether the reports demonstrated the potential benefits from Pennsylvania citizens’ investment in the Complex.

Updated Economic Impact Analysis: Petrochemical Facility in Beaver County, Pennsylvania (Clinton, Minutolo, and O’Roark 2021b), a report written by professors associated with Robert Morris University for Shell Chemical Appalachia LLC was released in 2021. For many readers, this report provided evidence to satisfy questions raised about the expected impact of the Complex on the regional economy before the Complex is commissioned in 2022.

I believe that the report produced by Robert Morris University researchers did not reduce the uncertainty about the wisdom of tax expenditures on the Complex. I assert that conceptual and methodological questions about this report from Robert Morris – and reflecting backward on the American Chemistry Council reports conducted with similar methods and using the same software – negate justification for public expenditures to support the construction and operation of the Complex. I do not deny that regional economic benefits will flow from the Complex, just that the reports were inadequate to uphold decisions made to allocate public expenditure for the Complex.

Leaders in the Commonwealth and Beyond Were Enthralled

Studies released about the potential economic impact of the Complex must have left a strong impression on the representatives of Pennsylvania citizens and other leaders. Public officials – high and low and across the spectrum of politics – stood firmly behind the promise and in the bright light of the Pennsylvania Petrochemicals Complex.

In 2019, President Trump visiting during construction of the Complex remarked that “These folks are from Shell, and this is a plant like no other. It’s just incredible….And we appreciate the investment, and we’re going to do everything possible to make [inaudible – perhaps, it successful? It work?] (“Remarks by President Trump During Tour of the Shell Pennsylvania Petrochemicals Complex | Monaca, PA the White House” 2019).” Governor Tom Corbett said, “The benefits to the state’s southwest and to all of Pennsylvania are immense” (Gibson 2012a, para. 9). Corbett felt that public investment in the Complex would leave a legacy of benefits for Pennsylvanians. He said, “What this does — it talks about whoever is governor after me, two or five governors after me, having an economy that is growing based on manufacturing that does not exist right now. So they will have money for education, for social services” (Detrow 2012c, para. 19).

Figure 4: Former President Trump Visits Site of Pennsylvania

Petrochemicals Complex, August 2019

(Image from https://tinyurl.com/trumpvisit)

General bipartisan praise for the Complex mirrored the enthusiasm of Trump and Corbett. For instance, State Senator Mike Kelly, a Democrat, welcomed the decision and praised Governor Corbett, saying, “Today’s announcement by Shell is a great day for all Pennsylvanians….I especially want to commend Governor Tom Corbett and his economic team for their efforts in securing this economic development project for Pennsylvania. Kudos to all who worked to bring this home and make it happen” (Gibson 2012a, para. 16 and para. 21).

State Senator Jay Costa, also a Democrat, applauded “the governor’s and the community’s efforts to land such a valuable enterprise and bring home the benefits this plant will provide for generations to come” (Gibson 2012b, para. 21). Marcellus Shale Coalition President Kathyrn Klaber noted that Shell’s decision to invest in the Complex was a “further indication of the Commonwealth of Pennsylvania and Governor Corbett’s continued work to responsibly develop the Marcellus and expand broad-based economic benefits for all” (Gibson 2012c, para. 6).

I defer to a subsequent major section of this blog posting my critical review of the recent report from Robert Morris University, a critical perspective which I believe applies similarly to the almost decade-old American Chemical Society reports. Necessarily prior, though, to motivate my criticisms is a common understanding of the inputs, processes, and outputs forming the Pennsylvania Petrochemicals Complex. So, next, I offer my bare-bones description of the operation of the Complex and refer to the information in this description in my subsequent review of the Robert Morris report.

Operation

of the Pennsylvania

Petrochemicals Complex

The Pennsylvania Petrochemicals Complex in Monaca will house seven ethane cracker units,7 two high-density polyethylene units and one low-density polyethylene resin manufacturing unit (potential of 1,600,000 metric tons of polyethylene annually), natural gas-fired combustion turbines co-producing steam and electricity, four emergency diesel generators, diesel-powered pumps, cooling towers, multiple fuel and storage tanks, multiple flaring units, an incinerator, air pollution control devices, and a wastewater treatment facility (RTP Environmental Associates, Inc. 2014b; State of Pennsylvania 2016, 5–7).8

Displayed in Figure 5 is my conception of the inputs, processes, and outputs of the Complex. For simplicity of presentation, the flow of activity portrayed in Figure 5 skims over many of the details of the ethane-to-ethylene-to-plastic resin process. I narrate some of the details about inputs, processes, and outputs that flow from top to bottom of Figure 5.

![*Inputs, Processes, and Outputs in the Operation of Pennsylvania Petrochemicals Complex.* <br> (Graphic drawn by David Passmore using DiagrammeR package in RStudio based on <br> general descriptions of ethane cracking and statements in air quality approval <br> application made by Shell [@rtpenvironmentalassociatesinc.2014]. Does not <br> show the flow of emmissions from utilites and general facilities processes <br> or fugitive emissions.)](https://davidpassmore.net/blogd/img/ProcessFlow.png)

Figure 5: Inputs, Processes, and Outputs in the Operation

of Pennsylvania Petrochemicals Complex.

(Graphic drawn by

David Passmore using DiagrammeR package in RStudio based on

general

descriptions of ethane cracking and statements in air quality approval

application made by Shell (RTP

Environmental Associates, Inc. 2014b). Does not

show the

flow of emmissions from utilites and general facilities processes

or fugitive emissions.)

Inputs

The Complex can produce 1.5 million metric tons of ethylene annually by cracking ethane molecules (RTP Environmental Associates, Inc. 2014b, 1–2).9 All of the ethane required is delivered to the Complex by the Falcon Ethane Pipeline System, a 97-mile pipeline network incoming to the Complex from Houston, Pennsylvania, and Cadiz and Scio in Ohio. (see Figure 6). Ethane transported by Falcon is unique — it is the only energy commodity that can morph from being sold mixed with natural gas or, alternatively, as a liquid feedstock for petrochemical plants, an attribute that contributes to ethane’s volatility of production volume and price. (Braziel 2022). As with many aspects of the construction and operation of the Complex, the Falcon Ethane Pipeline System has generated considerable controversy (see, e.g., “Real Talk on Pipelines” 2022).

Figure 6: Falcon Ethane Pipeline.

(Map from https://bit.ly/FalconPipeline)

Gas processing plants that separate liquids and remove solids or other particulate matter in the gas stream lifted from regional wells drawing from Marcellus and Utica shale formations provide input to these three nodes in the pipeline network. The three modes are tactically located proximal to clusters of wells producing “wet” gas. Some wells produce not only natural gas as methane, but also include natural gas liquids such as ethane, propane, butane, and isobutane. These products constitute as liquids by, depending on the gas pressure, condensing to become the “wet” portion of the natural gas (Hey 2017). In general, Marcellus and Utica shale formations in Ohio, southwestern Pennsylvania, and West Virginia involve wet gas (See Figure 7 for locations).

Figure 7: Locations of Wet and Dry Gas in Marcellus and Utica

Shale Formations.

(Map from https://bit.ly/wet-dry-gas)

Natural-gas-fired cogeneration turbines will produce steam for the ethane cracker and generate electricity for the Complex. Excess electricity generated through cogeneration will be sold for distribution in daily energy markets run by the PJM Interconnection electrical power grid serving selected northeastern U.S. states (RTP Environmental Associates, Inc. 2014b, 1–2). As much as one-third of the electricity output of the cogeneration units might become available for regional distribution (“New Shell Pennsylvania Petrochemicals Complex Takes Advantage of Shale Revolution,” n.d.).

Superheated pressurized steam in the cracker dilutes and vaporizes ethane. The heat from the steam splits the bonds between carbon and hydrogen atoms in ethane, a process called “pyrolysis,” to yield ethylene (more detail in Passmore (2022c), para, 5).

Oil & Gas Journal (Brelsford 2021) reported that the Complex also will draw 20 million gallons of water daily from the Ohio River. Some water not used to generate steam is used to cool the effluent produced by the cracker or to contribute to other processes at the Complex. Water is reused or returned to the river as a by-product after treatment to meet water quality standards. A by-product is a material produced as a residual of, or incidental to, the production process. In an accounting sense, by-products are associated with costs.

Unknown are the amounts and kinds of other inputs to the Complex beyond ethane, natural gas, and water. These other inputs could add to the costs of business of the Complex and affect the supply chain for the Complex in similarly unknown ways.

Processes

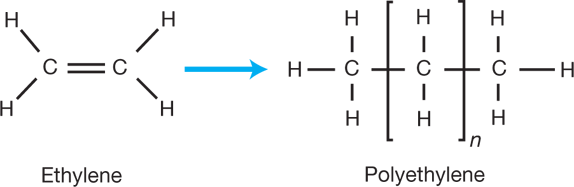

At the core of the Pennsylvania Petrochemical Complex are ethane crackers that generate ethylene for making polymer resin that, in turn, is extruded as small pellets.

Cracking

An ethane cracker is a furnace into which ethane is fed. The ethane is diluted with steam heated to approximately 1300° F. The heat of the furnace cracks ethylene from ethane molecules, freeing two molecules of hydrogen in the process and creating a double bond10 between carbon atoms (structures modeled in Figure 8). The hot gas mixture exhausted from the cracker is cooled, or “quenched (“Quench Water Coolers in Ethane Cracking Plant (Olefin Plant) - Hydrocarbons Technology,” n.d.),” with water to prevent further chemical reactions. Water and heat are recovered for recycling back into the cracking process, although some water is treated and discharged as a by-product of the Complex (Partlow 2022).

Figure 8: Comparison of the Chemical Structures of Ethane and

Ethylene.

(Image from https://insights.globalspec.com/images/assets/490/1490/LNG-04a.jpg)

Ethylene and other substances exhausting in a gaseous state from the cracker are compressed to a liquid state and then refrigerated. Fractional distillation further separates ethylene from the cooled, quenched mixture by taking advantage of differences in the vaporization point of ethylene compared with other chemical components of the mixture (Helmenstine, n.d.b).

Various gases that are by-products of cracking are burned into the air in a controlled combustion process called “flaring” (“Flaring - Energy Education,” n.d.), which releases carbon dioxide into the air as a by-product. Wastewater not reused in the cracking process but containing by-products from the cracker is collected, treated, and discharged. Then, the ethylene produced is stored for manufacturing plastic resins.

An important point of information is that Shell does not report ethylene cracked from ethane as a product of the Complex that is meant to be sold to customers. Its sole use is for creating plastic resin. Liquification of ethylene not used in polyethylene production is possible but not indicated for the Complex.11 I have not found any indication that Shell will produce ethylene as a co-product of the Complex.

Shell indicated that some co-products, such as “Solid components (coke/pitch/tar) are removed…and sent offsite for either use or disposal [and]….tar and light gasoline [are}…shipped offsite for further processing into products” (RTP Environmental Associates, Inc. 2014b, 3–4), although the volume and possible commercial value of these co-products are not reported. Co-products are goods or services that are incidental to main production and have market value to generate revenue. In contrast, a by-product typically is a material that is a consequence of production associated with costs.

Ethylene produced at the Complex is the primary input to polyethylene manufacturing, the next and final production stage in the Complex. Ethane cracking gathers more attention than polymerization probably because the ethane cracker forms a large footprint at the Complex and consumes most inputs of ethane, water, electricity, and steam to the Complex. The final product of the Pennsylvania Petrochemicals Complex sold to customers is, in fact, pelletized polyethylene resin, not ethylene. The nature of the final product manufactured at the Complex has significant consequences for the validity of estimates made of the economic impact of the Complex. More to that point subsequently in this blog posting.

Polymerization

Unique among elements is the capability of carbon to form single chemical bonds with up to four other atoms and to double or triple bond with itself, as in a double-bond ethylene molecule (again, see Figure 8). Carbon is one of the only elements, because of its bonding properties, that can create long chain-shaped molecules to form the basis for the fats, carbohydrates, nucleic acids (DNA and RNA), and proteins that serve as the basis of life itself. Chaining together ethylene molecules (monomers) through a chemical process called polymerization produces polyethylene (a polymer, which means “many parts”).

A catalyst suspended with ethylene molecules under pressure initiates polyethylene production. A catalyst is a chemical that speeds up chemical reactions, but is not consumed during the reaction. The catalyst bonds ethylene monomers into a long chain forming a polymer (see Figure 9 showing monomer and an n-length polymer). The polymerization process releases high amounts of heat.12 As a consequence, continuous cooling is required to prevent runaway chemical reactions (Burdett and Eisinger 2018a, 67) that could ruin the product or manufacturing equipment.

Ethylene passes to two gas-phase polyethylene units and one slurry technology unit to manufacture low-density polyethylene and high-density polyethylene. Processes in both units employ catalysts, but use different equipment and operating parameters to produce each specific grade of polyethylene. After the inclusion of additives and further conditioning, the polymer is extruded to form pellets, the primary product of the Pennsylvania Petrochemicals Complex.

Figure 9: Ethylene Monomers React With a Catalyst to Create

Polyethylene.

(Image from “How Polymer Branching & Molecular Weight

Impact Processability” (n.d.))

Outputs

Plastic resin in pellet form is the product of the Pennsylvania Petrochemicals Complex that has market value for Shell. At the same time, the Complex accumulates by-products of its industrial processes that have consequences for public health and environmental quality.

Polyethylene Resin Pellets

Polyethylene has many desirable attributes for manufacturing. In general, Kaiser (2021) noted that polyethylene can handle large loads without fracture and is flexible and stretchable. Polyethylene is light and versatile and absorbs no water. Low-density polyethylene resists many types of chemical reactions and impact, while allowing relatively easy fabrication and forming. High-density polyethylene is known for its outstanding tensile strength, large strength-to-density ratio, high-impact resistance, and high melting point.

Polyethylene is an excellent electrical insulator and can be produced to be transparent. Polyethylene has thermoplastic properties useful in production – i.e., it softens or fuses when heated and hardens and becomes rigid again when cooled. The Pennsylvania Petrochemicals Complex will produce high- and low-density polyethylene (see, respectively, “What Is High Density Polyethylene (HDPE)? | Acme Plastics” (n.d.) and “Low Density Poly-Ethylene - an Overview | ScienceDirect Topics” (n.d.)).

Nearly all polyethylene is sold after initial manufacturing as small (≅5mm), white, lentil-shaped pellets (see Figure 10), although round, flat, square, cylindrical, and various other shapes of many colors are manufactured. The pellets are known as “nurdles.” Nurdles are bagged and stored before distribution by rail or truck to warehouses or directly to customers. The added cost of pelletizing polyethylene is considerable (Burdett and Eisinger 2018b, 67), but nurdles are relatively easy to ship. Customers who buy pellets are not households, but are other businesses that use the nurdles in their own production, such as injection molding, extrusion, and blow molding.

Figure 10: White Nurdles.

(Photo from gentlemanrook -

originally posted to Flickr as Plastic Pellets - "Nurdles",

CC BY

2.0, https://commons.wikimedia.org/w/index.php?curid=4487785)

Plastic resin pellets are unit-priced by the pound for sale in downstream markets. Pellet prices are volatile (Pederson 2021) because they are driven on the supply side by equally volatile prices for natural gas and on the demand side by two major factors. First, consumers express preferences for “eco-friendly” packaging solutions. Second, environmental regulation of plastic products is increasing. Some observers believe nurdles are one of the most harmful toxic wastes released into the environment (see discussion by McVeigh (n.d.)).

By-Products

Many industrial processes create co-products and by-products.13 The Pennsylvania Petrochemicals Complex will generate electricity and, perhaps, some output of cracking as co-products. However, the Complex will create by-products, the cost of which Shell will bear, partly by paying for permits to discharge substances into the environment. Other costs of by-products will be borne separately by Pennsylvania citizens or jointly with Shell.

Cracking ethane emits by-products that can render the air, soil, water, or other natural resources harmful or unsuitable for further use. The Environmental Law Institute (n.d.) and Doyle (n.d.) inventoried many of the by-products of the Pennsylvania Petrochemicals Complex that could pose threats to human health and environmental safety.

Small inhalable particles emitted can damage short- and long-term human respiratory function. Volatile organic compounds emanate from cracking, such as ground-level ozone, benzene, and toluene, associated with respiratory and other health ailments. Permitted in treated wastewater to be discharged to the Ohio River are certain levels of benzene, benzo(a)pyrene, and vinyl chloride that are established human carcinogens.

Cracking also releases carbon dioxide, a gas that can absorb energy within infrared wavelengths. Collision with other molecules transfers this energy. Faster molecular motion produces heat. Trapped heat from this action of carbon dioxide in the Earth’s atmosphere is the “greenhouse effect” that has influenced the long-term warming of the planet’s overall temperature.

The Department of Environmental Protection issued a permit (Commonwealth of Pennsylvania 2015), valid through 2019,14 for the kinds and numbers of tons of annual emissions by the Complex listed in Table 1.

| Table 1. Tons of Permitted Annual Emissions by the Complex | |

|---|---|

| Air Containment | Permitted Emission Rate (tons) |

Nitrous Oxides |

348 |

Carbon Monoxide |

1,012 |

Filterable Particulate Matter |

71 |

Particulate Matter ≤10 micron diameter |

164 |

Particulate Matter ≤2.5 micron diameter |

159 |

Various Sulfur Oxides |

21 |

Volatile Organic Compounds (VOC) |

522 |

Flue & Fugitive Emissions of VOC |

620 |

Hazardous Air Pollutants |

30.5 |

Ammonia |

152 |

Carbon Dixide Equivalents |

2,248,932 |

| Source: Commonwealth of Pennsylvania (2015 | |

The Pennsylvania Department of Environmental Protection required for this first-of-its-kind facility in Pennsylvania complex environmental reviews, approvals, and permits for new construction, remediation of contamination from previous industrial activities on the property, and operation. The Department keeps a running list of news on its website (see “Shell Petrochemical Complex” (n.d.b) ) about the Complex, permits and approvals obtained for the construction and operation of the facility, and compliance/enforcement actions taken by government agencies to regulate the Complex.

How

Well Understood is the Potential

Economic Impact of Complex?

Shell Chemical Appalachia LLC made a complex, courageous, and consequential financial decision to build and operate the Pennsylvania Petrochemicals Complex. Shell says that the Complex will open sometime in 2022 (Shrum 2022b). The Commonwealth’s citizens also invest with Shell in the Complex. Foregoing current and future tax expenditures by the Commonwealth reduced Shell’s start-up costs, will subsidize purchases of ethane for cracking, and eliminates much of Shell’s state and local tax liability.

Although Shell and the Commonwealth invest jointly in the Complex, their investment goals differ. Shell aims to sell plastic pellets from the Complex for a profit. The Commonwealth wishes to benefit from the impact the Complex could have on regional jobs, income, business activity, and tax revenue.

Shell will review its balance sheets and earnings reports to judge its yield from the Complex. The Commonwealth certainly can review regional economic data that will emerge to account for the observed impact of the operation of the Complex, although I am not aware of any impact assessment plan. Shell-sponsored forecasts of the potential economic impact of the Complex seem to have provided the rationale for accepting the Commonwealth’s decision to invest in the Complex. However, potential ≠ a realized outcome.

I conclude that reports about the forecasts made public by Shell might have included conceptual orientations and methodological approaches that left the Commonwealth’s citizens without clear evidence of potential economic impact. Therefore, some explanation of my assessment is appropriate of the value of Shell’s forecasts of potential impact to justify Pennsylvania citizens’ trust in investment in the Complex.

In this major section of this blog posting, I critically review a 2021 report about the potential regional economic impact of the Pennsylvania Petrochemicals Complex (portions of cover in Figure 11. The preparation of this report, Updated Economic Impact Analysis: Petrochemical Facility in Beaver County, Pennsylvania (Clinton, Minutolo, and O’Roark 2021b), was supported by Shell Chemical Appalachia LLC. The importance of this report is that some among the public and its representatives might perceive that it satisfies questions about regional economic value of the Complex.15

When the Robert Morris report16 was released in 2021, the report’s authors were identified as faculty members in the School of Business at Robert Morris University. Earlier similarly produced economic impact reports by the American Chemistry Council appeared while the Pennsylvania legislature was considering incentives through tax expenditures to aid the construction and operation of the Complex. I believe that these Council reports share nearly the same methodology and analytics, as well as some of the same issues, evident in the Robert Morris report by Clinton, Minutolo, and O’Roark (2021b). Dissection of the Robert Morris report can also shed light on the American Chemistry Council reports’ validity.

Figure 11: Cover of Robert Morris University Report.

(Image captured from https://bit.ly/RMpetro and

edited to minimize

display space by David Passmore )

I structure my critical review of the Robert Morris report along three lines:

- Summary and Reflection. First, I summarize the Robert Morris report, accompanied by light annotation about some of the methods applied to generate the report.

- Issues. Next, I identify three issues in the Robert Morris report that left the Commonwealth’s citizens without clear evidence of the potential economic impact of the Pennsylvania Petrochemicals Complex: classification of the industry accounting for impact, identification of indirect impact, and appropriateness of a 40-year forecast of impact.

- Next Steps. Last, I describe briefly some ways that might prove useful for assessing any regional economic impact of the Complex. As far as I know, the Commonwealth does not plan to perform any impact assessment.

The Robert Morris Report: A Summary and Reflection

Focus

Shell engaged Robert Morris faculty members “to provide an independent analysis17 of the economic impact of the construction and operation of the contemplated petrochemical facility” by examining “direct economic changes in job creation and overall economic output, focusing on the construction and operational phases of the Project. Additionally, the multiplicative impacts of the Project are considered” (Clinton, Minutolo, and O’Roark 2021d, 7).

Impact Estimation

The analytics behind the report rely on input-output modeling, a data-based, computational, and most often prospective approach to unwinding the impact of projects, events, and changes in local economies. An input-output model accounts for goods and services that are required as inputs by industries to produce outputs of goods and services necessary to satisfy requirements for supplies to other industries or for delivery directly to consumers (Miernyk 1965).

Impact estimates computed for the Robert Morris report relied exclusively on IMPLAN software (“Economic Impact Analysis for Planning | IMPLAN” 2019) for input-output modeling to analyze “publicly available information” (Clinton, Minutolo, and O’Roark 2021e, iii). IMPLAN is described as the “gold standard” for economic impact analysis. An essay I authored (Passmore 2022a) describes the technical details of input-output modeling.

Although the regional economic impacts of building the Pennsylvania Petrochemicals Complex probably are substantial, construction is nearly complete as I write this blog posting. I, therefore, exclude construction impacts and, instead, emphasize the portions of the Robert Morris report focused on operating the Complex. I also exclude from my summary portions of the report that estimate the statewide impacts of the Complex. Clinton, Minutolo, and O’Roark (2021b) indicated that “Most of the impact for the proposed Project is expected to occur in Beaver County, Pennsylvania and SWPA [southwestern Pennsylvania]” (p. 10).

Geography of Potential Impact

The core of the Robert Morris report focused on Beaver County and, then, on a 10-county region of southwestern Pennsylvania. Pennsylvania counties comprised of Allegheny, Beaver, Armstrong, Butler, Fayette, Green, Indiana, Lawrence, Westmoreland, and Washington form the 10-county region (see Figure 12).18 Clinton, Minutolo, and O’Roark (2021b) constrained the analysis to these 10 counties even though, “It is anticipated that border counties in Ohio and West Virginia will be impacted” (p. 10).

Figure 12: 10-County Region in Southwestern, Pennsylvania.

(Map created by David Passmore using online tool

at https://www.mapchart.net/usa-counties.html

Clinton, Minutolo, and O’Roark (2021b) assumed workers from the 10-county region will fill 90% of jobs at the Complex and that 40% to 75% of the people who fill the new jobs will live in Beaver County (p. 13). These assumptions seem reasonable.

My analysis of the flow of workers into and out of Beaver County in 2019 (Figure 13) demonstrates that about one-half of workers in Beaver County also lived in the county and that another one-half traveled from outside Beaver County to work in the county. At the same time, almost 49,000 residents of Beaver County traveled to work outside the county.

Figure 13: Flow of Workers In and Out of Beaver County,

Pennsylvania, 2019.

(Image created by David Passmore from

inflow/outflow analysis

of Beaver County using LEHD On-The-Map

at https://onthemap.ces.census.gov/ )

My analysis of distances from work to home for all Beaver County workers in 2019, shown in Figure 13, reveals that one-half of all Beaver County workers lived within 10 miles of their places of work. Another one-quarter of Beaver County workers traveled from 10 to 24 miles from work to their places of residence. The remainder traveled more than 25 miles from work in Beaver County to home. Data not shown in Figure 13 revealed that almost two-thirds of workers traveling 50 or more miles from work in Beaver County went to homes north, northeast, and east of Beaver County. Also, 40% of workers traveling home between 25 and 50 miles went to homes southeast of Beaver County (i.e., from the direction of Westmoreland County).

Figure 14: Distance Traveled from Work to Home in Beaver

County, Pennsylvania, 2019.

(Image created by David Passmore

from distance/destination analysis

of Beaver County using LEHD

On-The-Map

at https://onthemap.ces.census.gov/ )

One impediment to defining an economic region by geopolitical boundaries, such as county lines, is the risk of misspecifying the economic region expected to be affected by the Complex. An economic region is a cohesive area in which commerce takes place. Of course, administrative or geographical boundaries can define an economic region, especially if governments govern commerce or terrain limits movement. However, commerce rarely respects map lines or many other impediments.

Other factors can define the economic region for the Complex, such as its laborshed (i.e., the region from which the facility draws its commuting workers, as I have provided in Figures 13 and 14) and proximal regional suppliers (i.e., firms close enough geographically to the Complex to supply goods and services). Perhaps a worthy approach moving forward will be to amend the boundaries of the economic region affected by the Complex to reflect the local supply of goods, services, and labor. Such as approach might properly include, for example, parts of Ohio or areas north of Beaver County, or, perhaps, removal of Fayette or Green counties from the economic region the Complex affects. Let the data that emerge after the Complex begins operation guide the establishment of the boundaries of the economic region that the Complex affects.

Estimates of Potential Impact

Job numbers for the operation of the complex were the sole inputs into the IMPLAN software to initiate the estimates in Table 1.19 Some assumptions stated in the report about job numbers that formed the starting point for estimation:

the Beaver County petrochemical facility will employ 600 fulltime people who will live and work in the region. We model the economic impact of this job creation on the Pennsylvania economy assuming that all workers who fill these jobs will reside in the Commonwealth. We also model the economic impact in SWPA assuming that 90% of the people who fill the new jobs reside in the region. Thus, 540 new jobholders will work and live in SWPA. Finally, we consider the impact of the new jobs on Beaver County. Based on comparative commuting patterns we assume that 40% to 75% of the people who fill the new jobs will live in Beaver County, generating 240 to 450 new jobs for people who reside there. (Clinton, Minutolo, and O’Roark 2021f, 13)

The authors reported that they analyzed the “Petroleum Refinery operation” industry (Clinton, Minutolo, and O’Roark 2021f, 8–9) to calculate the potential regional economic impact of the Complex. After excluding construction and statewide impact from my consideration, I extracted findings from the Robert Morris report. Recorded in Table 2 from the Robert Morris report are the potential annual economic impacts of operating a petroleum refinery on Beaver County, on a 10-county southwestern Pennsylvania area.

| Table 2. Potential Annual Economic Impact of Operation of a Petroleum Refinery in Beaver County, Pennsylvania | ||

|---|---|---|

| (millions of dollars or number of jobs) | ||

| Impact | Beaver County | 10-County Southwestern Pennsylvania Area |

| Value Added | ||

| Direct | $8,700 to $14051 | $29,266 |

| Indirect | $1,127 to $1,885 | $35,053 |

| Induced | $461 to $749 | $8,222 |

| Labor Income | ||

| Direct | $887 to $1,326 | $2,631 |

| Indirect | $386 to $646 | $12,998 |

| Induced | $246 to $400 | $4,822 |

| Jobs | ||

| Direct | 240 to 450 | 540 |

| Indirect | 267 to 501 | 5843 |

| Induced | 279 to 494 | 3744 |

| Earned Income Tax | ||

| State | $1.7 to $2.8 | $21 |

| Local | $0.6 to $0.9 | $7 |

| Source: Clinton, Minutolo, and O’Roark 2021b | ||

Displayed in Table 3 are the potential economic impacts over 40 years calculated for the Robert Morris report.

| Table 3. Potential 40-Year Economic Impact of Operation of a Petroleum Refinery in Beaver County, Pennsylvania | ||

|---|---|---|

| (millions of 2020 dollars discounted at 3.25% annually) | ||

| Impact | Beaver County | 10-County Southwestern Pennsylvania Area |

| Total Output | $10,715 to $17,882 | $175,074 |

| Vaue Added | $10,288 to $16,685 | $72,541 |

| Labor Income | $1,519 to $2,372 | $20,452 |

| State Tax | $35 to $55 | $471 |

| Local Tax | $11 to $19 | $153 |

| Source: Clinton, Minutolo, and O’Roark 2021b | ||

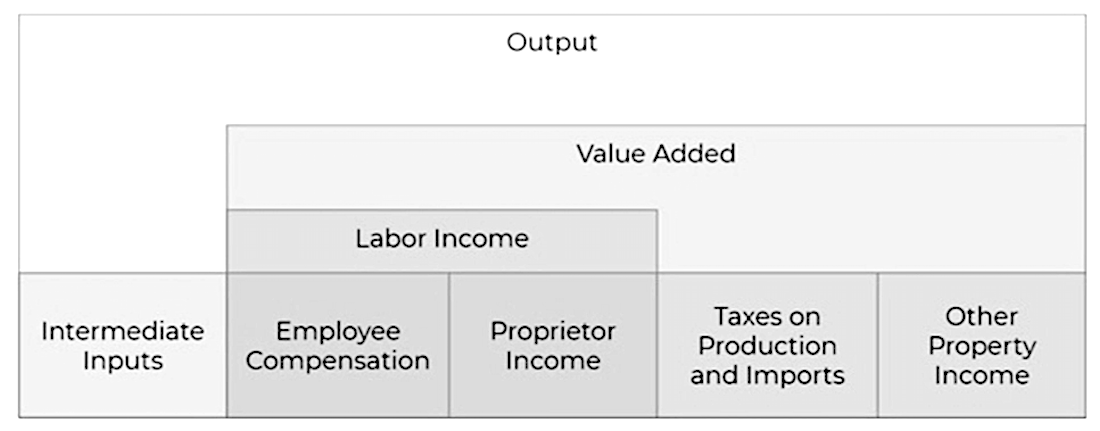

Measures of Potential Economic Impact

For the most part, definitions of components of economic impact offered in the Robert Morris report were not provided or cited in the Robert Morris report. Some of these concepts and terms are drawn from definitions used in national income and product accounting by the U.S. Bureau of Economic Analysis (“NIPA Handbook: Concepts and Methods of the u.s. National Income and Product Accounts | u.s. Bureau of Economic Analysis (BEA)” 2021; “Glossary | u.s. Bureau of Economic Analysis (BEA),” n.d.). Others are derived from the language used around input-output analysis (Clouse, n.d.b). Readers of reports of economic impact often impute different meanings of economic and technical concepts and methods than are intended by producers of reports.

The relationships and overlaps among some of the components of economic impact reported in Table 2 and Table 3 are shown in Figure 15. The components shown in Figure 15 are terms used in national income and product accounting. The components are organized hierarchically into overlapping categories.

Figure 15: Relationships Among Some of the Components of

Regional Economic Output,

Most of Which Are Estimated in the Robert

Morris Report.

(Image captured and recolored from https://bit.ly/IMPLANoutput)

Definitions of components of impact displayed in Table 2 and Table 3 include:

- Labor income equals employee compensation plus proprietors’

income.

- Employee compensation is the sum of employee wages and

salaries and supplements to wages and salaries. Wages and salaries are

measured on an accrual, or “when earned” basis, which may be different

from the measure of wages and salaries measured on a disbursement, or

“when paid” basis. Supplements to wages and salaries include employer

contributions for employee pension and insurance funds and of employer

contributions for government social insurance.

- Proprietor’s income is current–production income (including

income in–kind) of sole proprietorships and partnerships and of

tax–exempt cooperatives. Fees of corporate directors are included in

income of proprietors, but the imputed net rental income of

owner–occupants of all dwellings is included in rental income of

persons. Proprietors’ income excludes dividends and monetary interest

received by nonfinancial businesses along with rental incomes received

by persons not primarily engaged in the real estate business. These

incomes are included in dividends, net interest, and rental income of

persons, respectively.

- Employee compensation is the sum of employee wages and

salaries and supplements to wages and salaries. Wages and salaries are

measured on an accrual, or “when earned” basis, which may be different

from the measure of wages and salaries measured on a disbursement, or

“when paid” basis. Supplements to wages and salaries include employer

contributions for employee pension and insurance funds and of employer

contributions for government social insurance.

- Value added is labor income plus taxes paid on

production and imports and other property income.

- Taxes paid on production and imports, accounted as a

negative value, include include sales and excise taxes, customs duties,

property taxes, motor vehicle licenses, severance taxes, other taxes,

and special assessments.

- Other property income includes consumption of fixed

capital, corporate profits, and net of business current transfer

payments. It also includes income derived from dividends, royalties,

corporate profits, and interest income.

- Taxes paid on production and imports, accounted as a

negative value, include include sales and excise taxes, customs duties,

property taxes, motor vehicle licenses, severance taxes, other taxes,

and special assessments.

- Total output is the sum of value added plus

intermediate output. The U.S. Bureau of Economic Analysis

defines intermediate output as “Goods and services that are used in the

production process of other goods and services and are not sold in

final-demand markets” (“Glossary: Intermediate

Inputs,” n.d.). Intermediate Inputs are purchases of

non-durable goods and services such as energy, materials, and purchased

services that are used for the production of other goods and services,

rather than for final consumption. Purchases of intermediate goods are

business-to-business transactions. The Complex produces output that

becomes an intermediate input to other producers of plastic product

output.

- Jobs equal the count of part– and full–time jobs, including all federal, state, and local government employment, military employment, and self–employment. This definition does not count “in–kind work” without pay by family members as employment.

State and local earned income taxes were not calculated inside the IMPLAN model. Instead, the authors of the Robert Morris report calculated tax impacts outside the model using data from the model. The authors explain:

The project is expected to exert a substantial impact on state and local taxes. There will be a number of tax impacts such as income tax, property tax, and licenses and permits. The income tax is the most tractable. We assume a 3.07% state income tax rate for the Pennsylvania wage income and a 1% local rate. Given that labor income in the model includes both wages and benefits we assume that benefits are 34% of wages so that 75% of labor income would be taxed as wages and 25% would not be taxed because it relates to nontaxable benefits. (Clinton, Minutolo, and O’Roark 2021f, 15)

Total economic impacts on value added, labor income, and jobs are parsed in Table 2 into direct, indirect, and induced components as (using definitions by IMPLAN):

- Direct impacts are the initial effects on the economy of

the Complex. For example, referencing Table 2, the number of direct jobs

in Beaver County is 240 to 450, depending on assumptions about the

activity of the Complex. That is the range of the number of jobs that

the Complex could possibly employ.

- Indirect impacts are the effects of purchases of supplies

by the Complex from local industries. The range of jobs generated by the

Complex indirectly in local supplying industries is between 267 and 501.

Some supplies are purchased outside Beaver County and, therefore, are

not attributed to the impact of the Complex in the county.

- Induced impacts are effects of the regional economy that result from local spending of income earned by workers in the Complex and by workers in local industries that supply the Complex. The range of jobs induced by the Complex is between 270 and 494. Some of the income earned by workers at the Complex and workers in local supplying industries leaks outside the county or the southwestern region.

The sum of direct, indirect, and induced components in panel I of Table 2 is an estimate of the total potential impacts (depicted in Figure 16) of the Complex on regional value added, labor income, and jobs. Impacts-by-component, excluding taxes, were calculable only for estimates in panel I of Table. In another blog posting, I detail the technical aspects of calculating these impacts (Passmore (2022b), “Multipliers”).

Figure 16: Components the Total Economic Impact of the

Pennsylvania Petrochemicals Complex.

(Graphic drawn by David

Passmore using DiagrammeR package in RStudios.)

Did

Economics Play a Role in the Assessment

of the Potential Economic

Impact of the Complex?

Reading the Robert Morris report leads to a growing realization: This report about economic impact describes an accounting exercise, not an application of economics. The impressive technique of input-output modeling won the Nobel Prize in Economic Sciences in 1973 for Wassily Leontief (Leontief 1936, @leontief1966), an economist who developed theory and methods (“The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1973,” n.d.) that became computationally tractable with the advent of high-speed computing. Setting this impressive methodological accolade aside, the chief difficulty with the Robert Morris report – and many other reports relying on IMPLAN – is that it assembles a brief of benefits while ignoring costs, the assembly of which is key feature of economic analysis.

The John Locke Foundation is a firm critic of common input-output modeling applications. The Foundation claimed (“Economic Impact Studies: The Missing Ingredient Is Economics” 2017) that many input-output modeling efforts are heavy on accounting, but light on economics. In fact, many studies using input-output analysis consider only benefits of a project, but fail to consider or model any costs of a project. In this way, many technically complicated studies of economic impact represent attempts to advocate a project, not to research full impact, even though sophisticated research tools are applied. The sophistication of the research tools used can cast a patina of economic science over an analysis of only a portion of the components of a problem studied.

Of course, any new economic activity viewed without costs consistently will demonstrate unalloyed benefits. Something is larger than nothing, right? The “big-benefits-with-few-costs” approach is compelling to legislators, policy-makers, and funding agencies seeking to convince the public that projects, events, or changes are indispensable for economic growth and community revitalization (Sanders 2015).

The John Locke Foundation observed that input-output modeling is often conducted “by professional consulting firms that interest groups hire to do the studies. Furthermore, those who perform the studies seldom have formal training in economics. Instead their expertise is in using…proprietary [input-output] models (“Economic Impact Studies: The Missing Ingredient Is Economics” 2017)”. I am not asserting by quoting this sentiment from the John Locke Foundation that the authors of the Robert Morris report lacked training and expertise in economics. Their biographies reveal that they are seasoned economic analysts. Instead, I believe that the Robert Morris report represents an assertion of benefits without factoring in costs.

Ignoring costs and other modes of failure to think ahead to consider full economic consequences prompted Frédéric Bastiat, French economist best known for his journalistic writing in favor of free trade and the economics of Adam Smith, to write in his last published pamphlet in 1850 that:

In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen. (Bastiat 1964)

Attributing Responsibility for Assessing Potential Impact

I wish to attribute responsibility to the political and government representatives of Pennsylvania citizens, not to Shell or the authors of the Robert Morris report, for failing to exert due diligence over the evidence necessary to decide to expend tax revenue to support the operation of the Complex. The problem created by this failure probably outweighs any technical issues that might exist in the Robert Morris report.

I emphasize that Shell and the authors of the Robert Morris report were not compelled to offer a report that would include costs estimates as well as benefits for the citizens of Pennsylvania and their representatives. The problems, again, lie in the lack of due diligence by Commonwealth representatives. Instead, I suggest that the Commonwealth should have sought, either through a Commonwealth analysis or from an independent contractor, a report that displayed for the public the costs along with the benefits before expending tax revenue to partner with a private enterprise investment.

No evidence is available that public representatives of the Commonwealth’s citizens made their own independent assessment of the regional economic impact of the Complex. Instead, they accepted, mostly uncritically, the economic impact estimates and forecasts prepared for Shell and by other petrochemical industry associations to make their decisions about tax expenditures for the Complex.

To be sure, Shell did not pretend to support an economic impact report to meet the public’s needs for information. I can find nowhere in the report or in Shell’s public statements that the report was intended to thoroughly inventory the costs and benefits of building and operating the Complex for the public. As a private enterprise with shareholders should be, Shell focused on its own interests. We should not conflate Shell’s interests with the public interest. I do not make that assertion cynically but just observe that firms like Shell pursue free-market self-interest. Every stakeholder in these transactions needs to look after its own interests. Who was looking after the interests of Pennsylvania citizens?

Modeling efforts that produce analyses like those reported by the Robert Morris authors often run into discrepancies between the data needed and the data available for analysis. IMPLAN and other input-output modeling tools rely heavily on government data about economic activity. Governments usually release data not about firms but are agglomerated from private data provided by firms into clusters of information in categories that do not identify firms. Sometimes this discrepancy between what analysts want and need requires compromises, fitting a few square pegs in round holes and getting a result “near to the truth.”

Construction of a statement of the regional economic benefits of the Complex required many assumptions, analysis decisions, and compromises. I do not know the terms of Shell’s support for the Robert Morris report, but I suppose that the Robert Morris authors produced a technical report that satisfied Shell’s interests. The authors do not assert that the report is meant to serve the public’s interest. The report is not designed primarily to serve the entire interests of Commonwealth citizens.

I assess that the Robert Morris authors of the report handled well many technical constraints imposed by input-output modeling with IMPLAN and limitations levied by the regional data they analyzed. The report shows evidence of deft craftsmanship in conducting input-output analysis with IMPLAN. The authors seem well-qualified in education and experience to tackle this impact analysis. I base my assessment on my approximately 45 years of experience with input-output modeling and IMPLAN software, during which I completed about 130 economic impact studies.

But perhaps the most striking realization about the reception of the Robert Morris report and the American Chemical Society’s reports is that the Commonwealth did not feel the need to commission its own analysis of the potential economic impact of the Complex. The Robert Morris report and the American Chemical Society’s seemed sufficient to satisfy public representatives and officials that making tax expenditures on the Complex serves the public’s interests.

Three Issues Evident in the Robert Morris Report

I identify and discuss three issues evident in the Robert Morris report. These issues mostly evolve from technical matters that I believe affect the validity of the report to inform the public about the potential regional economic impact of the Pennsylvania Petrochemicals Complex. I focus on these issues because the Robert Morris report seems to be the only recent evidence of the potential economic impact that reinforced public decision-making to expend tax revenue on the Complex.

I am not under the illusion that identifying these three issues with the Robert Morris report changes anything. The Pennsylvania Petrochemicals Complex will spin up soon. The chemistry will cook. The plastic resin will be nibbled into nurdles. Pointing out technical matters about an economic impact report has little critical standing next to what appears to be a significant lapse of fiduciary duty by elected and appointed public officials meant to represent Pennsylvania citizens. Pennsylvania taxpayers became unwitting investors in a project, the Complex, for which the social costs were neither organized nor delineated by their representatives, who allowed the entity seeking the investment to define the project’s social benefits.

Classification of the Industry Accounting for Impact

The Pennsylvania Petrochemicals Complex is classified in the “Petroleum Refineries” industry in the Robert Morris report. I argue that, because the primary product of the Complex is polyethylene pellets, output from the Complex probably is best classified within the “Plastic Resin Manufacturing” industry. Differences in the classification of the industry in which the Complex is classified are important because data from a different industry likely would yield different impact estimates. IMPLAN notes that, although some industries are comparable, “each IMPLAN Industry has its own production function and spending patterns” (Clouse, n.d.c, para. 4).

The Complex Extrudes Plastic Resin; It is Not a Refinery

Abstracting from Figure 5, the flow between the ethane cracking process to the polymerization is shown in Figure 17. Ethylene is generated by cracking ethane at the Complex and becomes an input for polymerization. Ethylene is not an output of the Complex for sale to customers. Polymerized plastic pellets form the major output, the major product, of the Complex. Analysis of the Pennsylvania Petrochemical Complex as a petroleum refinery is an error. One more time for the folks in the back pews: The Complex sells polymerized plastic pellets from ethylene made at the complex. Ethylene made at the Complex is not a product of the Complex. It is an input to another process at the Complex.

Consider. You own a company that makes cans of noodles and meatballs in a tomato sauce. The company makes a lot of tomato sauce by processing tomatoes. Tomatoes are not the product. Tomatoes are one input to the product. Your company makes meatballs using meat purchased from an abattoir. Meatballs are not the product. They are an input to the product. The company cooks noodles made on site. Noodles are not the product. Noodles are an input to the product. When mixed and canned, tomato sauce, meatballs, and noodles form the final product your company sells to consumers. Your company is not a tomato sauce, meatball, or noodle manufacturer. Your company sells cans of spaghetti and meatballs in tomato sauce to wholesalers as a processed food product. The wholesalers distribute the canned product to a retailer. A mama might buy a can to put in her son’s thermos for a school lunch. You are in the Spaghetti Canning industry, not in a tomato, meatball, or noodle industry.

Figure 17: Ethylene is Generated at the Complex as an Input

for Polymerization.

Ethylene is not an output for Sale to

Customers.

Polymerized Plastic Pellets Form the Major Output of the

Complex.

(Graphic drawn by David Passmore using DiagrammeR

package in RStudios.)

The Authors of the Robert Morris Report Faced Analytic Compromises

The authors of the Robert Morris report had to shoehorn their analytic problem into the IMPLAN framework. Here is the compromise required to select the Petroleum Refineries industry analyzed by Clinton, Minutolo, and O’Roark (2021b) rather than Petrochemical Manufacturing:

“Within the IMPLAN application model, the ‘event’ selected for the operations phase of the economic impact is category number 154, ‘Petroleum Refiners’….While the [IMPLAN] dataset includes a classification for 159 Petrochemical Manufacturing, there is no multiplier and no underlying data to model the economic impact on since there is currently no such activity within the state of Pennsylvania. Therefore, the nearest analogous industry and multiplier to the previous study, Petroleum Refineries, was selected. (p. 8-9)

This attempt to get the best fit of available government income and product accounting data with the IMPLAN application is a common compromise that required professional judgment by the authors of the Robert Morris report. IMPLAN contains 546 industries for analysis agglomerated from thousands of industry categories from which federal statistical agencies obtain and classify data using the North American Industry Classification System (NAICS).

Classified by NAICS are establishments by the primary goods or services they produce (“What Is the NAICS Structure and How Many Digits Are in a NAICS Code?” n.d.). The “North American Industry Classification System (NAICS) u.s. Census Bureau” (n.d.) says, “Economic units that have similar production processes are classified in the same industry, and the lines drawn between industries demarcate, to the extent practicable, differences in production processes” (p. 3). Almost all statistics captured about economic activity by the U.S. Census Bureau, Bureau of Labor Statistics, and other government agencies are classified by NAICS codes. According to an online FAQ about the NAICS coding system (“North American Industry Classification System (NAICS) u.s. Census Bureau,” n.d.):

NAICS is a 2– through 6–digit hierarchical classification system, offering five levels of detail. Each digit in the code is part of a series of progressively narrower categories, and the more digits in the code signify greater classification detail. The first two digits designate the economic sector, the third digit designates the subsector, the fourth digit designates the industry group, the fifth digit designates the NAICS industry, and the sixth digit designates the national industry. The 5–digit NAICS code is the level at which there is comparability in code and definitions for most of the NAICS sectors across the three countries participating in NAICS (the United States, Canada, and Mexico). The 6–digit level allows for the United States, Canada, and Mexico each to have country-specific detail. A complete and valid NAICS code contains six digits.