Powder metallurgy (PM) is a generic term that includes techniques to produce solid metal-based products from powders. PM part manufacturing (PMPM, or simply PM\(^{2}\)) is a process for forming metal parts by sintering metal powders compacted in dies under pressure (PickPM, 2022b). “Sintering” is the process of heating the so-called “green compact” metal powder that was die-pressed into shapes (Rahaman, 2015). Sintering heats green compact parts just below their melting points in furnaces in controlled, gas-enriched atmospheres to produce finished metal parts.

The history of applying PM\(^{2}\) principles extends back as far as ≈3000 B.C.E. (Adams, 2015), although commercial production of PM\(^{2}\) accelerated in the late 1800s (Horizon Technology, 2019). In 2022, PM\(^{2}\) is forecasted to account for only 6.5% of revenue generated by the U.S. metal stamping and forging industry (Haupt, 2022a, p. 18), of which PM\(^{2}\) is a part. However, PM\(^{2}\) has been historically the most profitable product segment of the metal stamping and forging industry (Haupt, 2022b, p. 12).

The PM\(^{2}\) industry is a significant part of the history of the economy and technology of Pennsylvania. PM\(^{2}\) in the United States is highly concentrated in the north-central region of Pennsylvania. The history and performance of this concentration of PM\(^{2}\) within a rural Pennsylvania region offer an example of how a geographic cluster of human, natural, technological, and capital resources can establish a niche in the national economy and exert technical leadership globally.

As narrated in a historical account assembled by Atlas Pressed Metals (2022), north-central Pennsylvania PM\(^{2}\) is rooted in the late 1800s production of pressed carbon in St. Marys, Pennsylvania, to make metal graphite brushes for the then-emerging electric power industry. Carbon pressing techniques developed to make these parts were transferred to making carbon electrodes for deployment in electric arc steel furnaces in Pittsburgh. Then, inspired by porous carbon bearings exhibited at the 1932 World’s Fair in Chicago, carbon producers began to explore the growing possibilities of PM\(^{2}\) after World War II. When employees of these companies gained experience, they spawned their own companies for PM\(^{2}\). As production expanded, technology advanced, and PM\(^{2}\) expertise clustered around St. Marys, north-central Pennsylvania began branding itself as the “Powder Metallurgy Capital of the World” (see, e.g., DeLillo (2016); St. Marys Chamber of Commerce (2022)).

In the remainder of this posting, we review the scope and operations of the PM\(^{2}\) industry. First, we explain common processes for PM\(^{2}\). Next, resource and product markets for PM\(^{2}\) are described. Then, we analyze U.S. Census Bureau data to account for the dense concentration of PM\(^{2}\) in north-central Pennsylvania. Last, some forces affecting PM\(^{2}\) growth and change in the U.S. are considered.

Assembling this review was challenging. The PM\(^{2}\) research literature published in refereed journals focuses on physics, chemistry, engineering, and metallurgy applications to PM\(^{2}\) processes. Few textbook resources are available about PM\(^{2}\), primarily because PM\(^{2}\) receives scant attention in the education of engineers. For instance, engineering students receive approximately one-half hour of lecture devoted to PM\(^{2}\) during their undergraduate experience at Penn State. As a result, expertise in PM\(^{2}\) often is acquired in practice, sometimes by entrepreneurs and innovators without formal engineering training.

Information about the organization, economics, and finances of PM\(^{2}\) is provided primarily in industry market reports sitting behind paywalls, in conference presentations, through audiovisual works, in blogs posted on company websites, and in the literature distributed by professional associations. To assemble our view of the scope and operation of PM\(^{2}\), we reviewed the extensive gray literature about PM\(^{2}\) and relied on discussion and advice received during interviews and meetings with various PM\(^{2}\) producers in north-central Pennsylvania and through contacts we made with suppliers and customers for PM\(^{2}\).

Processes

I synthesized a straightforward, coherent narrative about PM\(^{2}\) processes from various online sources. Included among these sources is a section about powder metallurgy provided in the Library of Manufacturing (2022), in Summer School materials for the European Powder Metallurgy Association (Arnhold (2017); Grande (2016); Whitaker (2008); Zanon (2017)), and in company and professional association blogs and websites (among many: ISQ Directory (2022); MachineMaker (2022); Mechanicalland (2021); Metal Powder Industries Federation (2008); PickPM (2022), (2022), (2022); Powder Metallurgy Review (2016)).

Conventional Pressing

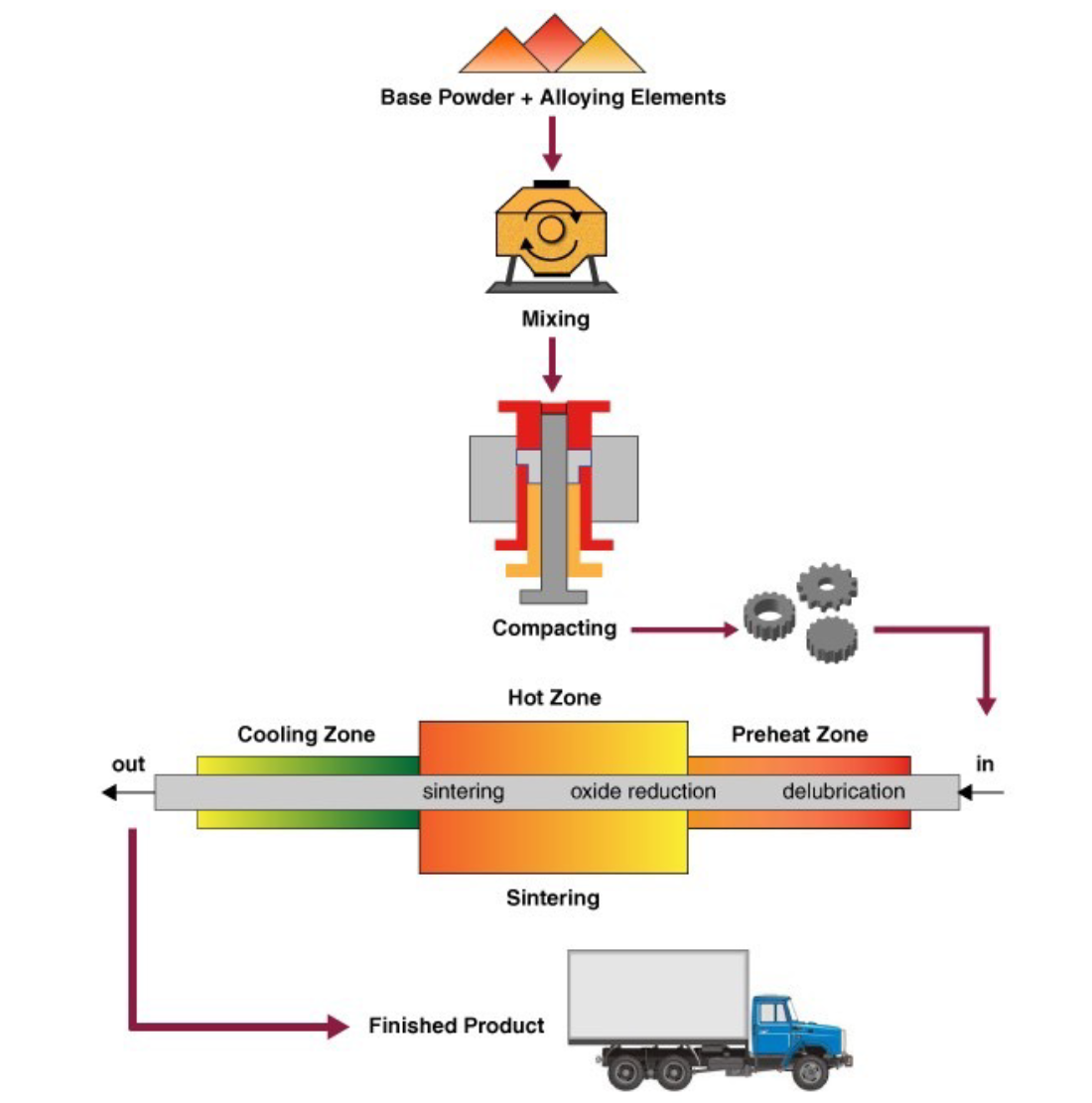

A process, diagrammed in Figure 1, known as press–and–sinter is the core, conventional PM\(^{2}\) process. In this process, custom–blended metal powders are fed into a die, compacted by a punch into the desired part, ejected from the die, and then sintered in a controlled atmosphere furnace at a temperature below the melting point of the base material. Press–and–sinter processes offer relatively low manufacturing and tooling costs and produce close tolerances in the finished parts.

Figure 1: Conventional powder metallurgy process

General attributes of the PM\(^{2}\) process include elimination or minimization of machining; reduction of scrap and waste due to “net shape” processes; close dimensional tolerances; relatively low energy use (e.g., metal need not be melted); and ability to produce complex shapes (examples of parts in Figure 2). However, to eject the pressed green compact part from the die requires certain part design constraints. For instance, parts with undercuts, grooves, threads, knurls, reverse tapers, or orifices at angles to the direction of pressing are ill-suited for PM\(^{2}\). Also, a green compact part resembles the greenware stage of ceramics production because the part ejected from the die has just enough structural integrity to be handled and transported. As a result, part design is essential. For instance, sufficient radii of inner and outer flanges and the overall thickness of parts are required to maintain the integrity of a green compact part before sintering. Gear design for PM\(^{2}\) is another example of a design constraint. An adequate modulus of gear teeth is necessary to allow powder to fill a die and to maintain sturdiness before sintering, Refer to PickPM (2022) and Penafiel (2017) for additional design considerations.

Figure 2: Examples of complex structures produced through powder metallurgy

Metal powders are elemental or alloyed metals mixed with binders, lubricants, deflocullates, and additives before pressing. A binding mixture consolidates the loose powder. Lubricants are necessary because clearances values between punches and dies used for powder pressing typically are less than .001 inch. Deflocullates stop the metal powder from clumping. Introducing additives can improve powder composition machinability, wear resistance, or lubricity. Force for pressing for most parts typically varies between 10,000 lbs/in2 (70 MPa) and 120,000 lbs/in2 (800 MPa). Parts for this type of manufacture are mostly small (under 5 lbs), and press requirements are typically under 100 tons. Presses with capacities of several thousand tons are sometimes used for work requiring more force. Double action presses, with opposing top and bottom punches, are common to reach the level and distribution of powder desired for compaction. The pressure the press can deliver dictates the upper limit of the size of a part. Increasing the speed of pressing enhances productivity, but pressing too fast can trap air that can prevent the part from compacting properly.

In 2019, press-and-sinter processes produced approximately 93.0% of the volume of worldwide PM\(^{2}\) industry output (Grand View Research, 2020a). However, various PM\(^{2}\) processes are available, some of which can add high market value but have correspondingly high production costs:

- In metal injection molding, metal powder is conventionally

injection molded to produce a green compact for sintering.

- Isostatic pressing confines metal powder inside a flexible

membrane surrounding a mold which acts as a barrier between the metal

powder and a liquid or gas pressurizing medium. Isostatic pressing is

adapted especially to relatively large, complex-shaped parts.

- Powder forging compacts metal powders into a “preform”

shape in a die. The preformed shape is sintered. The sintered preform is

coated with a lubricant and is closed die forged (CFS Forge, 2022). Forging causes plastic

flow, resulting in a dense, non–porous, dimensionally–precise, low waste

part that possesses desirable mechanical properties.

- Spray forming is used to produce semi-finished mill

products in the form of billets, tubes, and sheets through high–rate

deposition of atomized powder metal layer-by-layer onto a substrate to

form, after their solidification, a bulk product or thick coating.

- An innovative PM\(^{2}\) process generating considerable attention is additive manufacturing, a group of fabrication processes through which three-dimensional parts are constructed by adding layers of materials on point, line, or planar surfaces (Hassanin & Jiang, 2015)—i.e., 3D printing using fine grade metal powders. Metal injection molders are researching potential manufacturing marriages with additive manufacturing processes (Metal Powder Industries Federation, 2019).

Sintering

Sintering creates metallurgical bonds between the powder particles, adding desirable mechanical and physical properties to the part. Sintering occurs in a sintering furnace in a controlled atmosphere that can enhance PM\(^{2}\) part properties by, for instance, regulating oxidation, reduction, and carbon content, making heating and cooling uniform, producing a uniform microstructure of the product, and adding corrosion resistance. Since the late 1970s, a nitrogen/hydrogen mix has become the atmosphere of choice for PM\(^{2}\) sintering (Dwyer, 2022; Minghe Casting, 2021).

The typical sintering furnace contains a continuous mesh belt moving through three operating zones: (a) a pre-heat zone that burns off binders and lubricants added at the pressing phase and increases the temperature of the green part; (b) a hot zone in which the part raised to 70% to 90% of its melting point; and (c) a cooling zone, in which the part’s temperature is gradually lowered. Post–sintering processes also can occur, such as machining, repressing (for decreased porosity and increased hardness), impregnating with oil or resin (to produce a self–lubricating part), infiltrating with another metal (to remove residual porosity and enhance part strength), plating, coating, deburring, welding, steam treating (to oxidize surfaces for strength and density improvement), or furnace brazing with other parts. However, an efficiency feature of PM\(^{2}\) is that most finished parts require little or no secondary machining operations, such as stamped or forged parts.

A practical and distinguishing metallurgical feature of PM\(^{2}\) processes is that parts for sintering are not subject to Gibbs’ phase rule ((Verret et al., 2020, p. 227) that would apply if these metals were alloyed by melting. This feature means that PM\(^{2}\) does not face many of the same chemical, thermal, and containment restraints placed on materials alloyed by melting due to intersections and disjunctions of their various liquid and solid phases (Powder Metallurgy, 2022).

Markets

For Resources

PM\(^{2}\) purchases many of the inputs to processes from suppliers, just as most complex manufacturing operations do. However, PM\(^{2}\) producers purchase two critical supplies (PickPM, 2022a). One set of inputs includes metal powders, lubricants, binders, additives, and other raw materials that go into making finished parts. Another set consists of the tooling, process equipment, industrial gases, and related services. Also, some PM\(^{2}\) producers might choose to outsource post-sintering product finishing.

Metal powder is a unique and essential input to PM\(^{2}\) processes. In north-central Pennsylvania, ferrous metal powder is dominant in production. Ferrous powder accounted for 89% of the global volume share of metal powder purchased in 2019 (Grand View Research, 2020b). Atomization is the most popular method of metal powder production (Library of Manufacturing, 2022). In the gas atomization technique, the most common atomization method (Uygun, 2021), molten metal is provided through a nozzle, where it is atomized by an inert gas jet. This inert gas jet separates the molten metal into small metal dimples. These dimples solidify to produce metal powder. The powder can vary by shape, porosity, flow and friction characteristics, surface chemistry, and bulk density and is mixed before packing to include lubricants, binders, deflocculates additives, and additional materials (Library of Manufacturing, 2022).

Tooling is another critical and unique input to PM\(^{2}\) processes. A close fit of a punch with a die is necessary so that pressed metal particles do not become stuck in the clearance between the punch and die. Most punches and dies are made from hardened tool steels, the surfaces of which are ground and polished or lapped in the direction of tool movement. Tungsten carbide is used to make punches and dies for more powerful powder pressing operations. These features demand high tolerance production of machine tooling and dictate careful tool use, maintenance, and care requirements.

Many PM\(^{2}\) suppliers—gas furnace fabricators, gas suppliers, machine shops—are proximal to PM\(^{2}\) producers in the north-central Pennsylvania region. Metal powder is supplied from outside the region.

For Products

The global PM\(^{2}\) market was valued at $7.49 Billion (US) in 2020 and is projected to reach $12.63 Billion by 2028, growing at a compound annual growth rate of 6.77% from 2021 to 2028 (Verified Market Research, 2021). The increasing demand for PM\(^{2}\) parts in manufacturing automotive components is a significant factor in this global growth (Grand View Research, 2020c; Research & Markets, 2020; Zanon, 2017), especially in China and India (MENAFIN, 2022). The automotive industry is the customer for most of the PM\(^{2}\) parts produced in north-central Pennsylvania.

According to the Metal Powder Industries Federation (2022), the typical U.S. light-duty vehicle contains about 37 pounds of PM\(^{2}\) parts. Pickup trucks average about 60-95, depending on the configuration. The standard U.S. passenger sedan averages 20 pounds. More than an estimated 1.5 billion PM\(^{2}\) powder forged connecting rods have been made for light-duty vehicles produced in the U.S., Europe, and Japan. Commercial aircraft engines contain 1,500-4,400 pounds of PM\(^{2}\) per engine.

The automotive industry and its consumers are moving quickly away from the internal combustion engine in favor of fully electric vehicles and hybrids, however. Increased sticker prices have made new vehicles less affordable for some consumers. The average income of a new vehicle buyer was $124,000 in 2021 (Deka & White, 2021). And, with global supply disruptions and rising inflation, the number of vehicles sold in the United States in early 2022 plummeted (Rosevear, 2022). Consequently, the demand for PM\(^{2}\) connecting rods, main bearing caps, and other internal combustion engine components is likely to decline.

The PM\(^{2}\) industry hopes to leverage its extensive experience in supplying the automotive industry experience to supply electric vehicle producers. For instance, GKN Power Metallurgy is responding to the increasing demand for a stable supply of permanent magnets, which are vital components of electric vehicle motors (Klaus, 2022). Fiodin & Kianan (2021), based on a teardown of a Tesla vehicle, found that the use of PM\(^{2}\) parts in transmissions of electric vehicles could lower manufacturing costs by approximately 20% (p. 50). Other markets are emerging. For instance, aerospace and defense demand for PM\(^{2}\) parts is increasing in the PM\(^{2}\) market (Stratview Research, 2022), but not a large factor in north-central Pennsylvania PM\(^{2}\) output.

Concentration in North-Central Pennsylvania

Employment and wages in PM\(^{2}\) in the United States are highly concentrated in just three rural counties in north-central Pennsylvania: Jefferson, Elk, and Cameron (See Figure 3). The Economic Research Service of the U.S. Department of Agriculture classifies these three counties as rural due to relatively low population density and distance from metropolitan areas (USDA ERS, 2013). Our analysis of Economic Research Service data sets (USDA ERS, 2022) revealed that two counties (Jefferson and Cameron) experience moderately high household poverty levels. Less than 20% of the population of these two counties have completed high school. All three counties have experienced long-term population declines. These socioeconomic conditions accent the importance of PM\(^{2}\) dominance for the economic well-being of residents in the three-county region.

![*Jefferson, Elk, and Cameron Counties in Pennsylvania contained 38% of establishments, employed 38% of workers, and paid 36% of wages in PM$^{2}$ (NAICS 332177) in the United States, 2021 4th Quarter* <br> ( Map created using MapChart [-@mapchart2022]. Calculations of shares of establishments, employment, and wages using data from Bureau of Labor Statistics [@bureauoflaborstatistics2022]. NAICS 332177 is a six-digit classification used for classifying PM$^{2}$ industry activity by the U.S. Census Bureau [-@bureauofthecensus2022].](https://davidpassmore.net/blogd/img/powd/PMMap.png)

Figure 3: Jefferson, Elk, and Cameron Counties in Pennsylvania

contained 38% of establishments, employed 38% of workers, and paid 36%

of wages in PM\(^{2}\) (NAICS 332177)

in the United States, 2021 4th Quarter

( Map created using

MapChart (2022).

Calculations of shares of establishments, employment, and wages using

data from Bureau of Labor Statistics (Bureau of

Labor Statistics, 2022). NAICS 332177 is a six-digit

classification used for classifying PM\(^{2}\) industry activity by the U.S. Census

Bureau (2022).

Documented in Table 1 is the high concentration of employment and wages in PM\(^{2}\) in north-central Pennsylvania. The PM\(^{2}\) industry makes up a much larger share of Pennsylvania’s employment total than it does for the nation.1 The concentration of PM\(^{2}\) employment and wages in Pennsylvania is more than 13 times the concentration of employment and wages for PM\(^{2}\) in the U.S. workforce. Pennsylvania is the location for 38% of all U.S. establishments producing PM\(^{2}\) parts.2

| Table 1. Powder Metallurgy Parts Manufacturing Establishments, Employment, Wages, and Employment and Wages Location Quotients in the United States, Pennsylvania, and Selected Pennsylvania Counties, 2021 4th Quarter | |||||

|---|---|---|---|---|---|

| Region | Establishments1 | December Employment | Total Wages2 | Employment Location Quotient3 | Wages Location Quotient4 |

| U.S. Total | 167 | 8702 | $130,033 | 1.00 | 1.00 |

| Pennsylvania | 63 | 4622 | $64,025 | 13.56 | 13.18 |

| Pennsylvania Counties | |||||

| Cameron | 5 | 388 | $8,014 | 3882.58 | 7833.02 |

| Elk | 32 | 2276 | $30,685 | 2899.67 | 3838.84 |

| Jefferson | 6 | 655 | $8,377 | 758.76 | 996.84 |

| Source: https://bit.ly/PA332117 | |||||

| 1 An establishment is generally a single physical location where business is conducted or where services or industrial operations are performed. | |||||

| 2 In thousands of nominal U.S. dollars. | |||||

| 3 Employment Location Quotient = local concentration / national concentration, where local concentration = local PM employment / local all-industry employment, and national concentration = national PM employment / national all-industry employment. | |||||

| 4 Calculated same as Employment Location Quotient, but substitute Total Wages for employment in calculations. | |||||

Even more remarkable are the extraordinarily high concentrations of PM\(^{2}\) employment and wages in the three counties—i.e., concentrations of employment and wages between 758 and 7833 times higher than in the nation. These very dense employment and wage concentrations indicate the dominance of PM\(^{2}\) in north-central Pennsylvania in the national PM\(^{2}\) industry. Jefferson, Elk, and Cameron counties in Pennsylvania contained 38% of establishments, employed 38% of workers, and paid 36% of wages in PM\(^{2}\) in the U.S. during 2021.

High industry employment and wage concentrations in PM\(^{2}\) within the region, relative to the nation, highlight the importance of the industry for exports from the north-central region. Shields (2003) stated, “An exporting industry is one where the industry not only meets the demand for its products, but also produces enough so it can sell outside the region….A location quotient greater than 1.0 indicates that the economy is self–sufficient, and may even be exporting the good or the service of that particular industry” (p. 3). Industries such as PM\(^{2}\) sell exports outside a region to contribute to the region’s economic base. Economic base theory (explicated in Munroe & Biles (2005)) suggests that the means for strengthening and growing the local economy is to develop and enhance the exporting sectors (Klosterman, 1990, p. 115). In this way, PM\(^{2}\) is a driving “engine” for the north-central Pennsylvania economy.

Competitive Forces

We analyzed competitive forces affecting the PM\(^{2}\) in north-central Pennsylvania using techniques specified by Porter (1998); see also Porter’s Five Forces Analysis (2022)). The analysis drew on information from structured face–to–face and telephone meetings, gleaned during plant tours and over informal lunches, and captured in confidences revealed in unstructured personal conversations. Competitive forces identified were summarized around five themes: the threat of entry of new competitors; bargaining power of customers; bargaining power of suppliers; the threat posed by substitute products; and the nature of competitive rivalry within the PM part manufacturing industry. We conclude that the environment for PM\(^{2}\) in north-central Pennsylvania is highly competitive.

The threat of entry of new competitors. The potential of profitable markets can draw firms to the region’s PM\(^{2}\) industry either through acquisitions and mergers or through start-ups. New entrants can affect the competitive climate in many ways. For example, new entrants can bring additional capacity to the PM\(^{2}\) industry in the region, capture market share from incumbents, bid down industry prices, or inflate incumbent’s costs, and, in these ways, effectively affect the profitability of incumbents.

Bargaining power of customers. Customers for PM\(^{2}\) parts from north-central Pennsylvania are primarily from the highly concentrated automotive industry. These PM\(^{2}\) customers enjoy strong bargaining power for PM\(^{2}\) part prices. In some cases, customers drive the industry’s prices down, bargain for more or better service at the same or lower prices, and pit firms in the industry against one another. PM\(^{2}\) firms in north-central Pennsylvania produce standard, undifferentiated PM\(^{2}\) parts, so buyers face low costs of switching among PM\(^{2}\) producers.

Bargaining power of suppliers. A small number of suppliers affects the PM\(^{2}\) industry in north-central Pennsylvania. For example, suppliers can raise prices in response to changes in their own markets or reduce the quality of their products without lowering prices. At the extreme, some suppliers refuse to work with a firm or charge excessively high prices for unique resources. Because few suppliers are available, few supply substitutes exist, and costs to the PM\(^{2}\) firms for switching suppliers are high, suppliers hold strong bargaining power.

The threat of substitute products. Substitutes for PM\(^{2}\) parts increase the propensity of customers to switch to alternative products in response to price increases. High elasticity of substitution for some PM\(^{2}\) parts by product alternatives limits the potential returns in the PM\(^{2}\) industry by capping price changes. Attractive price/quality substitutes for PM\(^{2}\) parts place a tight lid on PM\(^{2}\) firm profits in north-central Pennsylvania. Competitive rivalry within the industry. North-central Pennsylvania contains a close community of PM\(^{2}\) firms. Rivalry among firms is a significant determinant of the PM\(^{2}\) competitive climate in the region. Rivalry for advantage in product and resource markets often occurs along price dimensions. Regional rivals also compete aggressively on non–price dimensions such as innovation, marketing, branding, public recognition, and family rivalries.

Concluding Remarks

The PM\(^{2}\) industry is a small niche within the metal stamping and forging industry in the United States. PM\(^{2}\) firms in north-central Pennsylvania hold a large portion of that small niche. Although PM\(^{2}\) in the region depends on the automotive industry for demand for press-and-sinter parts for internal combustion engines, opportunities are emerging for producing PM\(^{2}\) parts for electric vehicles. The PM\(^{2}\) industry cluster in north-central Pennsylvania is an example of a successful regional agglomeration of manufacturing leading to regional economic advantage and technological leadership.

This posting is a draft of a manuscript in preparation in collaboration with Rose M. Baker, Department of Learning Technologies, University of North Texas, Denton, Texas, and Chungil Chae, Business and Public Management, Wenzhou Kean University, Wesan, China.

Last updated on

[1] "2022-08-05 15:50:22 EDT"Acknowledgements

I received helpful advice about this posting from Paul Sedor, Vice

President of Member and Industry Relations for the Metal Powder

Industries Federation. I also benefited over the years from

conversations and advice from powder metallurgy producers and their

suppliers and customers. Ellysa Cahoy, Education & Behavioral

Sciences Librarian at Penn State University, solved several problems

limiting integration into RMarkdown of Zotero .cls code to

implement citation and reference guidelines from 7th edition of the

Publication Manual of the American Psychological Association.

She also found at https://data-lessons.github.io/literate-programming-r-demo/04-bibliographic-citations/

suggestions for managing in-text citations from Zotero in RMarkdown.

Your Comments & Corrections

To make comments about this posting or to suggest changes or corrections, send email to David Passmore, send a direct message on Twitter at @DLPPassmore, or send an IMsg or SMS to dlp@psu.edu.

Reuse

Source code for this blog is available at https://github.com/davidpassmore/blog. Text, illustrations, and source code are licensed under Creative Commons Attribution CC BY 4.0 unless otherwise noted. Any figures/photos/images/maps reused from other sources do not fall under this license and are recognized by text in captions starting: “Figure from…” or “Photo from…” , “Image from…” or “Map from….” Sources for these external media are cited in captions.

A PM\(^{2}\) industry analyst told me that the Bureau of Labor Statistics undercounts establishments and employment in the PM\(^{2}\) industry due to inconsistencies and flaws in the way that NAICS codes are assigned to establishments.↩︎

Refer to Bureau of Labor Statistics (2021) and Wheeler (2005) for additional detail about calculation and interpretation of location quotients.↩︎